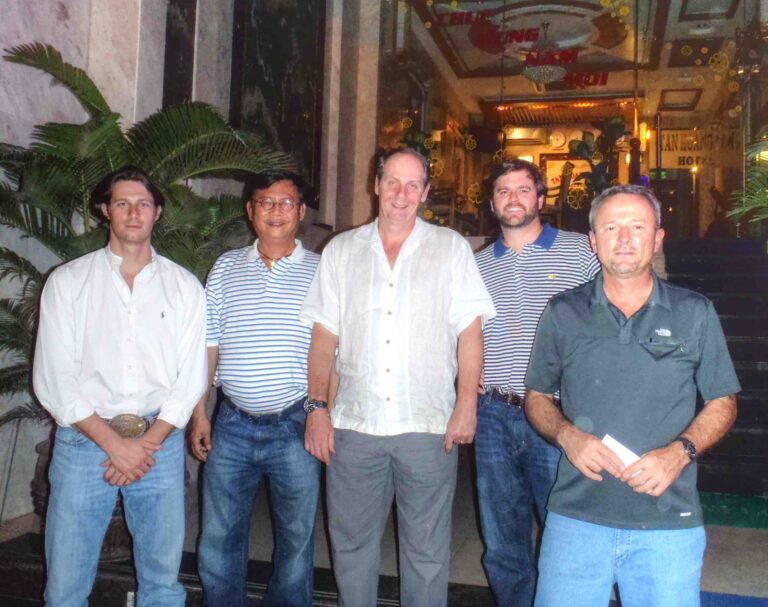

Greene Le Corp Consulting and Trade Service

Greene Le Corp’s headquarter is located in Pawleys Island, South Carolina. We have been involved in Vietnam business for over 25 years; we understand the laws and cultural practices and speak the language. Moreover, we also have an office in Vietnam that can refer specialists who will handle your business venture professionally. We will evaluate your concern conscientiously and provide an effective plan and path forward for your business endeavour. Our trade service is to introduce US firms to Vietnam’s markets and compatible Vietnamese business associates. As a result, in assisting US companies in searching for new materials out-sourcing via our network relationship with other Vietnamese manufacturers.

- Management and business development consulting for small and mid-sized businesses

- Product sourcing for US and Vietnamese Buyers

- Importing Vietnamese manufactured products into the US

- Real estate and business investment consulting, primarily in Vietnam

- Exporting US Technologies to Vietnam

Our product sourcing and importing channels offer significant savings to our clients due to the much lower material and labor costs in Vietnam

As an import agency to the US, European, and Japanese markets, GLC has proven capabilities to assist our trade service clients. Once our collaboration is initiated, we will search for Vietnam businesses that can provide materials, products, and services to meet your requirement. GLC will serve as your agent in Vietnam, ensuring that:

- Quality standards, shipping and delivery requirements, production capacities, and other requirements are fulfilled.

- Appropriate contracts and documentation are in place to protect your interests and conform to Vietnam’s import/export laws, tax and duty schedules, insurance requirements, and other international trade requirements.

GLC has researched hundreds of Vietnamese suppliers throughout each region of Vietnam. From the extensive research, we have selected the pre-qualified the best manufacturers of specific products within specific markets. Additionally, we have working relationships with these high-quality suppliers. We have established these relationships with company executives, touring their facilities, and working with them to assure export product quality, capacity, and timeliness.

With the government focus on economic development through the increase of exports and the approval of the Bilateral Free Trade Agreement (BTA), these businesses are more than happy to receive our assistance while giving us the opportunity to pre-qualify their products as suitable for US export. By being here in Vietnam coupled with our experience in the country, we have sufficient connections in each major Vietnamese market to be able to pre-qualify any supplier or manufacturer with confidence.

Manufacturing in Vietnam

There has been an influx of original equipment manufacturing and original design manufacturing (OEM/ODM) in Vietnam with satellite factories popping up through the country with most of this coming over from China. There are many economic and geo-political driving factors. Smart, forward-thinking companies are moving to diversify the geopolitical mix from where products are sourced. Most are more interested in finding new resources outside of China than finding new technology.

For decades China has been a good supplier. However, the costs of sourcing from China have increased over the years, and now with the burden of tariffs and deteriorating political relations, some importers are reaching the tipping point. World trade is a zero-sum game, which means there is one pie, and it gets cut up into several slices. If one guy gets a bigger piece, someone else gets a smaller amount. We sent more work to China as it was a great value proposition, which means less work was left for the US workers, unions, and other well-paid employees here. This was great for our bottom line and made our product lines more competitive. But over the last few decades, our infrastructure has been hollowed out. Neither Democratic nor Republican politicians had interest in R&D tax credits or incentives for our innovations to be built in new factories here, or retraining workers who lost their jobs to offshoring.

Regardless of your politics, our relations with China are not going well and continue to deteriorate. China’s renewed legal constraints in Hong Kong, tensions with Taiwan, currency manipulation, and finger-pointing from the pandemic have added fuel to the fire. The risks and repercussions of overly concentrating the supply chain in one geographical/political source are now painfully apparent. Moving away won’t be easy for Asian transplants in China, as they are finding the supply chains there are more developed compared with emerging markets. However, Vietnam has made major strides on the supply chain front. So, for those looking to make a move from China, Vietnam looks to be the best option. Primarily due to its close proximity to China, and therefore, close access to parts via air, sea, or land. And yet Vietnamese government is offering tax breaks and subsidies to those industry leaders who would want to set up their business in the country. We are entering “The Golden Age” of Vietnamese manufacturing.

Vietnam is the easternmost country on the Indochina Peninsula and is bordered by China to the North, Laos and Cambodia to the west, and part of Thailand to the southwest. Hanoi has been the capital city since the reunification of North and South Vietnam in 1975, while the largest city is Ho Chi Minh City (Saigon). Da Nang City and port is in central Vietnam. Since 2000, Vietnam’s economic growth rate has been among the highest in the world and Vietnam’s production base has matured. Industrial parks are located throughout the country. The attitude toward US visitors is very friendly. Domestic flights are inexpensive and safe. Cross-country, Ho Chi Minh City (Saigon) to Hanoi is a 2-hour flight, and HCMC to Da Nang is 1-hour-and-20-minute flight.

The minimum wage is approximately $1,000 per year, but in the main cities, salaries are much higher. However, Vietnam factory salaries for the same work are currently half the cost or less than China salaries. China manufacturers have already moved significant production to Vietnam. Vietnam has quickly become a new fronter for labor intensive manufacturing. While the wages are low, there are more than 60 colleges and universities in Vietnam, with quite a few that offer engineering degrees, including graduate programs. French was the official language of Vietnam from the beginning of French colonial rule starting in the 1850s until they were kicked out in 1954. Literacy in Vietnam is more than 97%, compared to 79% in the US.

Vietnam attracted nearly $40 billion USD in foreign direct investment last year. Currently, South Korea is the country’s biggest source of outside financing— making up more than 20% of all foreign direct investment flowing to Vietnam. Second is Hong Kong — with nearly the same amount, but that story is looking quite bleak. Singapore, Japan, and China round out the top five foreign investors in Vietnam. However, US firms are also increasing their presence in Vietnam, sometimes by way of their suppliers. Apple’s largest assembly contractor Foxconn has recently increased its presence in Vietnam. In 2007, Foxconn announced that it would invest $5 billion in Vietnam, and this was expected to help bring Vietnam into the global supply chain. Foxconn kick started its Vietnamese investment by opening two factories, worth $160 million in total.